An etf is an exchange traded fund that generally holds assets. However currency exchange traded funds etfs are a simpler way to benefit from changes in currencies without all the fuss of futures or forex by simply purchasing etfs in your brokerage account.

Tax Advantages For Forex Traders Finance Zacks

Tax Advantages For Forex Traders Finance Zacks

Over the past decade foreign currency etfs have surged in popularity allowing those who have equity brokerage accounts to gain access to this market.

Forex currency etfs. There are many ways to gain exposure to the currency markets. Why currencies move. Theres widely differing opinions about whether currency etfs are appropriate for retail investors.

Most currency etfs are a bet that the currency that they are traded in will outperform or underperform a specific currency or basket of currency. These currency etfs are a simpler highly liquid way to benefit from changes in currencies without all the fuss of futures or forex. Currency exchange traded funds etfs and exchange traded notes offer simple ways to increase portfolio diversification and gain exposure to the currency markets.

You simply purchase them as you would any etf in your brokerage account ira and 401k accounts included. With the advent of etfs individual investors now have the ability to gain exposure to this large and tremendously important asset class. The exchange rate will rise or fall.

For example a! forex etf is likely to hold. Institutional investors banks an! d hedge funds traditionally dominated the currency markets. A currency etf is designed to follow a very specific currency or in some cases a basket of currencies allowing an investor access to more than one foreign currency.

Dollar index bullish fund uup with 29211m in assets. Currency etfs can be used to hedge inflation portfolio risk and foreign risk. Foreign exchange rates refer to the price at which one currency can be exchanged for another.

Currency the largest currency etfs etf is the invesco db us. Click to see returns expenses dividends holdings taxes technicals and more. Currency etfs are like pre packaged investments that track a certain currency similar to how a normal etf tracks a correlating index.

You simply purchase them as you would any etf in your. 20 etfs are placed in the currency category. These currency etfs are a simpler highly liquid way to benefit from changes in currencies without all! the fuss of futures or forex.

Currency etfs etfs can be found in the following asset classes. For example a canadian dollar denominated tsx traded currency etf that is bullish on the us dollar would see a return hopefully relative to the movement of the canusd index.

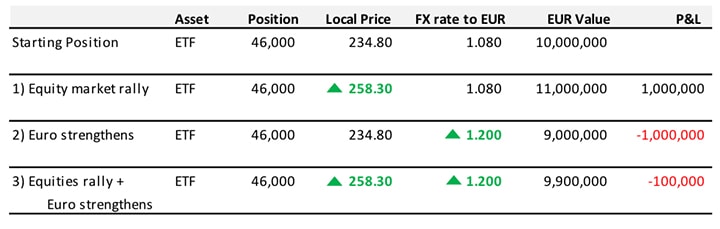

Intl Investing Currency Risk In Equity Portfolios Cme Group

Intl Investing Currency Risk In Equity Portfolios Cme Group

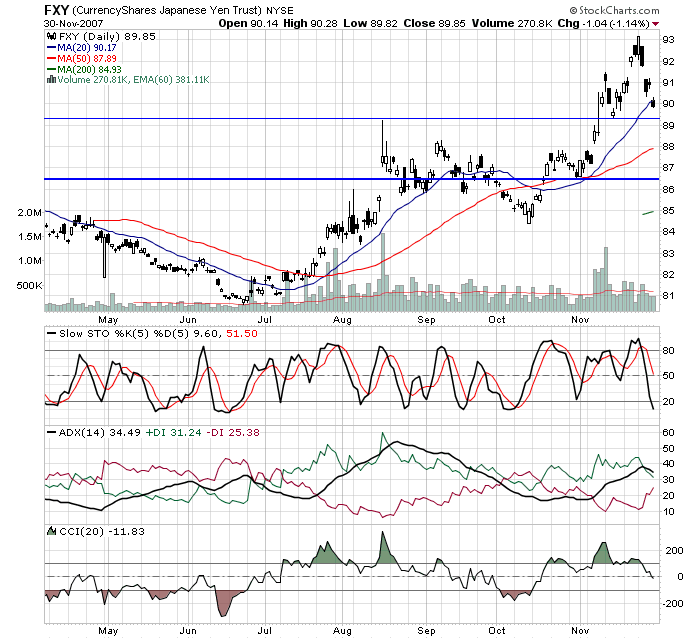

Two Cu! rrency Etfs That Should Outperform Seeking Alpha

Two Cu! rrency Etfs That Should Outperform Seeking Alpha

Gold Trading Futures Vs Forex Vs Etfs Vs Physical Forex Training

Gold Trading Futures Vs Forex Vs Etfs Vs Physical Forex Training Forex Alert The Yuan Might Be In Play Nasdaq Com

Markets Com Forex Und Cfd Broker Erfahrungen Bewertung

Markets Com Forex Und Cfd Broker Erfahrungen Bewertung

Are You Planning To Join The Trading Hype Here Are 4 Of The Best

Are You Planning To Join The Trading Hype Here Are 4 Of The Best

Buying An International ! Etf Check Its Corresponding Currency Etf

Currency Etf The Importance Of Australian Forex Brokers When

Currency Etf The Importance Of Australian Forex Brokers When

Exchange Traded Funds Etf Trading Strategies Netpicks

Currency Fx Etfs Best Etfs

Currency Fx Etfs Best Etfs

Pse Data For Amibroker

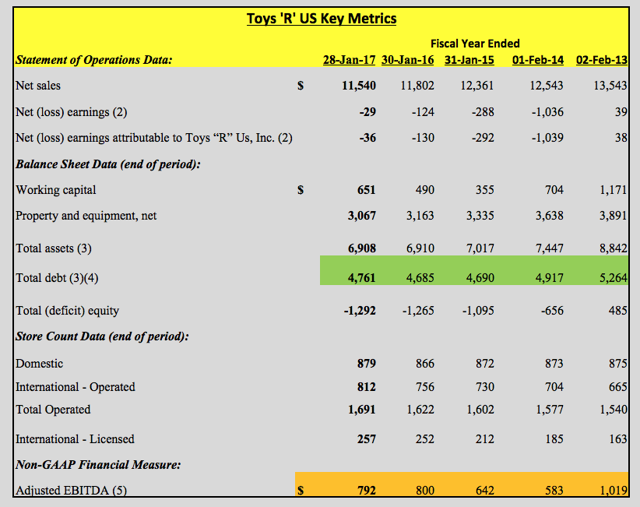

Currency Hedging A Double Edged ! Sword For Equity Investors The

Powershares Db Usd Index Bullish Etf Etf Uup Guggenheim

Powershares Db Usd Index Bullish Etf Etf Uup Guggenheim

Invest In Currency Etfs Uk Forex Trading Website